Introduction

Incoterms is an abbreviation for International Commercial Terms. It is a contract that defines the responsibilities of sellers and buyers in international trading and business transactions for the sale/purchase of goods. Businesses all over the world have adopted Incoterms as a standard method of transacting. These rules are universally recognised by governments and legal authorities worldwide. Acquiring a working knowledge of Incoterms is essential for conducting international business because they clearly state how buyers and sellers share tasks, costs, and risks. Incoterms were first adopted in 1936 by the International Chamber of Commerce (ICC); since then, ICC has revised Incoterms several times to accommodate ever-changing business needs, the most recent being Incoterms 2010.

Why are Incoterms so vital for businesses involved in global trading?

There are some vital elements and components that put Incoterms on the centre stage when it comes to facilitating global trade; we discuss some of those points here:

Incoterms help to reduce risk.

Many people believe that correctly specified wording in a contract is sufficient to guarantee that all parties adhere to their contractual responsibilities in international commerce. However, it is possible that language barriers and the implications/meaning of words in one place will not be reflected or understood in another. For example, in a particular country, they may use the terms tariff for local taxes. In another country, the tariff may refer to taxes, fees and any other kind of surcharges imposed by the federal, state or local government. This difference in the use of terms may be confusing. The usage of Incoterms avoids discrepancies in terminology by ensuring that all parties in a trade agreement have the same meaning of particular words. Consequently, the likelihood of difficulties during shipping decreases since all parties are clear about their respective duties in carrying out trade under the terms of the contract governed in a standard way by Incoterms.

Failure to comply with Incoterms may result in problems.

While managing international shipping, all parties involved must be aware of the technical details of all the respective Incoterms. When a supplier fails to grasp the proper meaning of each Incoterm that both parties are using, it will cause difficulties across the whole supply chain. Furthermore, incorrectly utilised Incoterms may have a detrimental impact on the payment of products, delivery schedules, higher expenses, poor inventory management, and unfavourable customer relations. Improper or missing Incoterms have a significant effect on the flow of products from distribution centres to shipping destinations and the reputation of the business that has issued them.

Incoterms have an impact on financial gain and competitive advantage.

Having defined the financial and procedural elements of all the international shipping procedures, Incoterms are critical in guaranteeing that sellers get the payments of their products and services correctly and on time. When buyers and sellers do not use Incoterms correctly, a business may not get paid for all goods and services. This malpractice can happen due to cultural differences and misconceptions, leading to a conflict over duties. On the other hand, Incoterms guarantee that all parties can retain a competitive edge in the international supply chain. Suppose the regulating body of a particular shipper changes the language used in the industry; in that case, these changes may directly affect the competitive advantage of the businesses involved. One business may profit from using the local language, while the other company may face capacity restrictions and shipping laws in the nation in question. Consequently, using Incoterms in international commerce reduces bribery and unethical commercial practices. Therefore engaging Incoterms is critical to avoid possible penalties and fines in international trade.

Incoterms adapt to change as per the trends in the global supply chain.

The International Commercial Terms (Incoterms) are revised every ten years to reflect developments in the worldwide supply chain. Most of the time, the buyer is the one who is responsible for establishing Incoterms for a particular contract. However, the duty for properly using Incoterms transfers from the buyer to the seller and depends on the specific nature and mode of transportation used. When it comes to ensuring that all international commerce takes place in a consistent way, Incoterms play the most critical function. Buyers and sellers would be subjected to frequent changes in language and problems in shipping procedures if the Incoterms were not in place. On the other hand, Incoterms clarify responsibilities and assist shippers in maintaining standard functions throughout the shipping process.

There are nine points at which commodities may move through as part of the freight process, listed in the following order:

The ICC has defined a total of 11 Incoterms for international trade. ICC designed it to demonstrate the transfer of responsibility from the seller to the buyer. For example, the Incoterm EXW (ex-work) deems the seller to have the least amount of responsibility. In the same manner, Incoterm DDP (Delivered duty paid) requires the buyer to bear the least amount of liability. We may infer that the rest of the Incoterms fall somewhere in between these two extremes.

Now that we understand some of Incoterms’ essential aspects and elements let us look at each of the incoterms one by one.

1 – EXW (Ex-Works)

When using Ex-works, the seller has the least amount of liability. The seller is responsible for delivering the commodities to the buyer at the seller’s premises, depot, or any other agreed location. From that point on, the buyer is solely responsible for the transaction and bears all risks.

- The delivery point is the seller’s place of business.

- The buyer is liable for the expenses of transporting the goods from the seller’s premises to the destination and importing them.

- The buyer is responsible for arranging all means of transportation.

- Purchasing insurance is the responsibility of the buyer.

2 – DDP (Delivered Duty Paid)

DDP is the absolute reverse of Ex-Works. It refers to transferring goods from the seller’s premises to the buyer’s premises or any agreed location. The seller is responsible for delivering the items to the buyer’s premises, depot, or other agreed location. The seller has the highest proportion of obligation.

- The delivery point is either the buyer’s premises or another agreed location.

- Seller will manage and pay for the cargo and any export and import duties, and the seller will also arrange for the shipment’s transportation.

- The seller will be liable for the shipment of the goods if the goods transport by sea.

- Purchasing insurance is the responsibility of the seller.

3 – FCA (Free Carrier)

FCA refers to multi-modal transportation needs, such as container or roll-on/roll-off traffic by trailers, trucks, ships, and ferries. When the items transfer to the carrier’s custody at a designated location, the seller has fulfilled their responsibilities. If the buyer and seller do not outline the location at the time of the contract of sale, the parties shall refer to the location where the carrier should pick up the goods and put them in its possession or control. In case of a loss or damage to the products, the risk transfers from the seller to the buyer.

- The delivery point is either the seller’s premises or another agreed location.

- The buyer is liable for the expenses of transporting the goods from the seller’s premises to the destination and importing them.

- The buyer is in charge of arranging all means of transportation.

4 – FOB (Free Onboard)

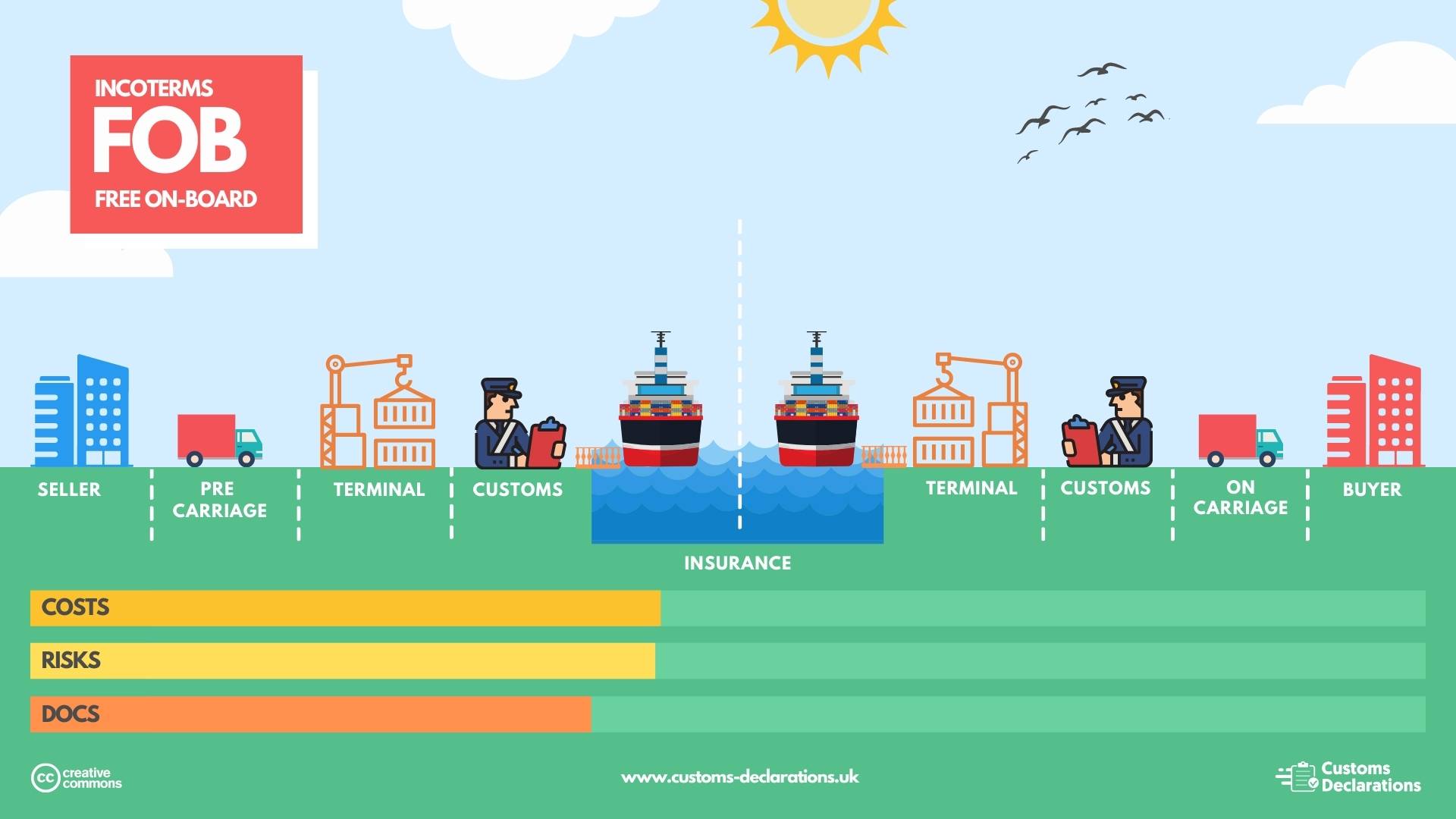

Free on-board refers to the seller delivering the consignment to the carrier of the buyer’s preference without charging any additional fees. When it comes to FCA and FOB, there is just a minor difference. The method of transportation is one of the differences. While FCA is suitable for multi-modal transportation, FOB refers to maritime transport. When cargo is shipped using FOB, the seller transfers the risk to the buyer at the delivery time. In FCA, the seller has to load the consignment onto the carrier arranged by the buyer; usually, the carrier is used first before the primary carrier.

5 – CFR (Cost and Freight)

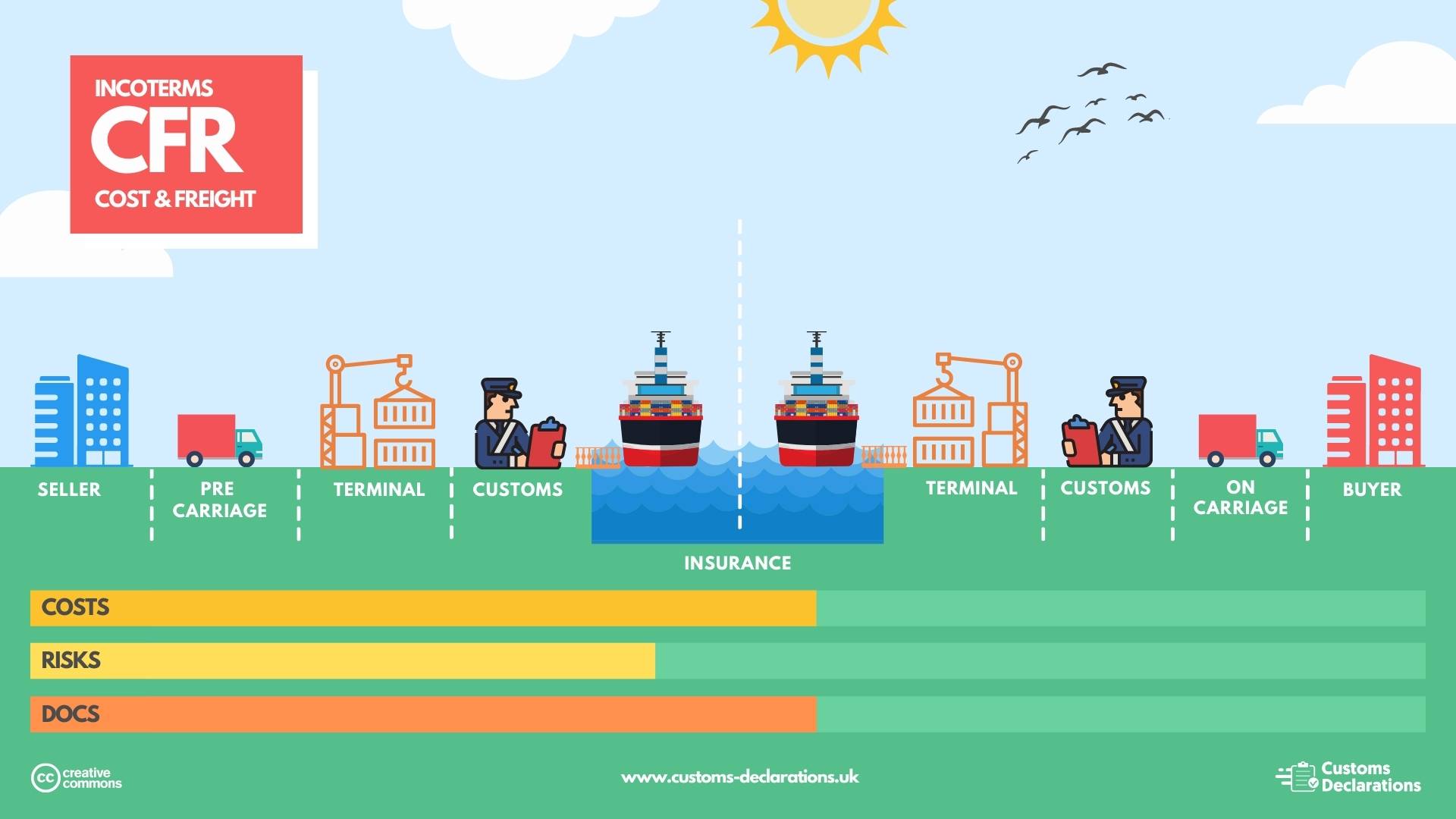

Cost and freight refer to the fact that the seller pays the cost and freight of the shipping to the destination, but the risk is on the buyer’s shoulders. It’s important to note that there is a significant variation between CFR and FOB Incoterms. When cargo is delivered FOB, the seller transfers the risk to the buyer as soon as the package crosses the ship’s dock. However, under CFR, the seller is also responsible for paying the expenses and freight until the cargo reaches its destination. We raised this point earlier in the article; arranging transportation does not imply that the risk transfer to the entity arranging the transportation. Although the seller provides the primary mode of transportation (The seller is the shipper in this instance), he has already delivered the cargo or transferred risk to the buyer upon shipment over the ship’s dock.

6 – CIF (Cost, Insurance and Freight)

The sole difference between CFR and CIF is insurance, which is a small but noticeable distinction. When the shipment arrives on the carrier, the seller transfers the risk to the buyer. However, the seller also makes arrangements for the primary carrier (The seller is the shipper). The seller is also responsible for the purchase of insurance to protect the buyer’s interests throughout the transportation of the cargo. Since the seller would be paying to cover the buyer’s risk, he would naturally want to have the bare minimum of insurance to meet his responsibilities. The buyer must consider this and, if necessary, get additional insurance.

7 – FAS (Free Alongside Ship)

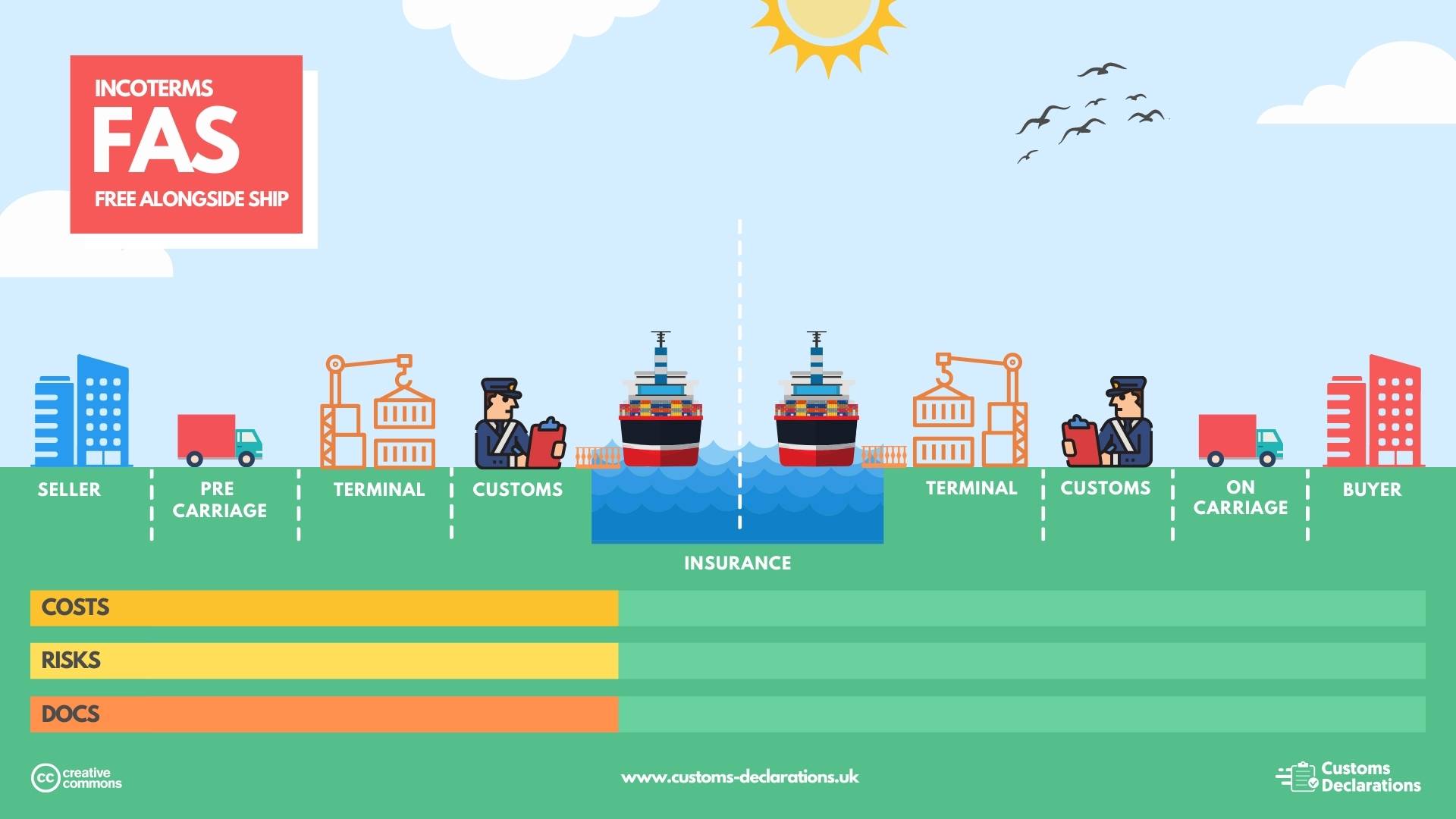

It’s as straightforward as it seems. The buyer arranges the primary carrier (The buyer is the shipper). Once items dock the ship, the seller delivers the shipment to the buyer and the risk transfers from the seller to the buyer. Following this point, the buyer is solely liable for all insurance expenses.

8 – CPT (Carriage Paid To)

The seller is responsible for the primary transportation to deliver the cargo to the agreed-upon location. On the other hand, the seller transfers the risk to the buyer upon delivery to the primary carrier. We stressed previously in the article, “Arranging the primary mode of travel does not imply that the organising party bears the risk.” Even in this scenario, the risk transfers to the buyer.

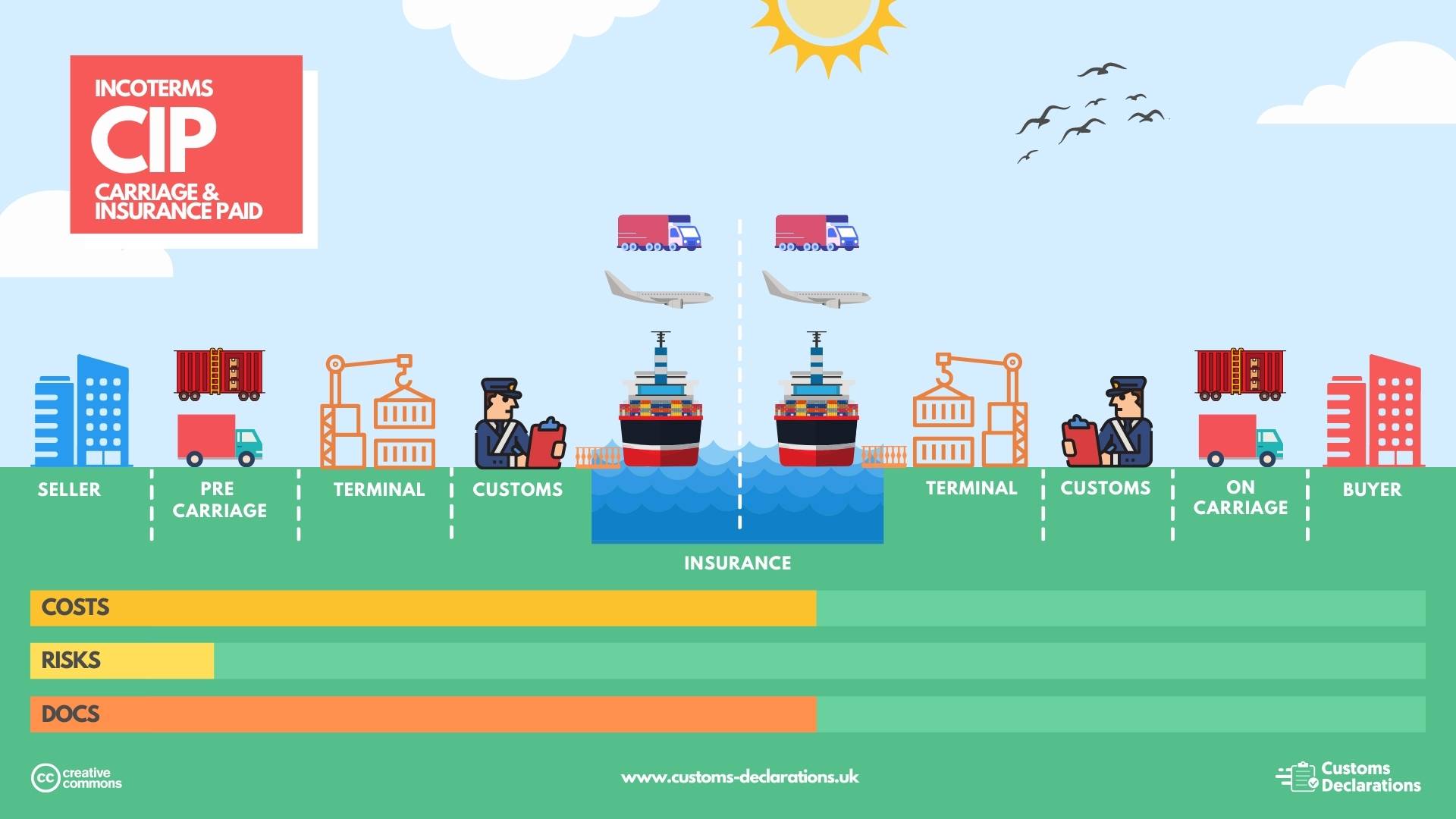

9 – CIP (Carriage and Insurance Paid)

CIP is a contract in which the seller delivers the products and transfers risk to the buyer upon delivery to the primary carrier. The seller organises and pays for the primary carrier to deliver the shipment to the specified location (The seller is the shipper). Additionally, the seller arranges for insurance on the buyer’s behalf to cover the buyer’s risk. The primary distinction between CPT and CIP is that the seller is also responsible for insurance. We stated earlier that “arranging insurance does not imply that the risk transfers to the person arranging the insurance.” The seller pays for the insurance in this case, but the risk is not his. The seller provides for insurance to protect the buyer. According to the CIP method, the seller will offer insurance coverage equal to 110 percent of the cargo’s total value in the case of a claim. The purchaser must insure himself against any additional risks he believes should be covered.

10 – DAP (Delivered at Place

DAP denotes that the seller delivers when the shipment arrives at the ultimate destination, ready for unloading from the method of transport. The seller will be liable for all associated risks and expenses with transporting the items to this location.

- The seller is responsible for export duties, transportation charges, insurance, and destination port costs.

- The buyer is responsible for import duties and unloading the items.

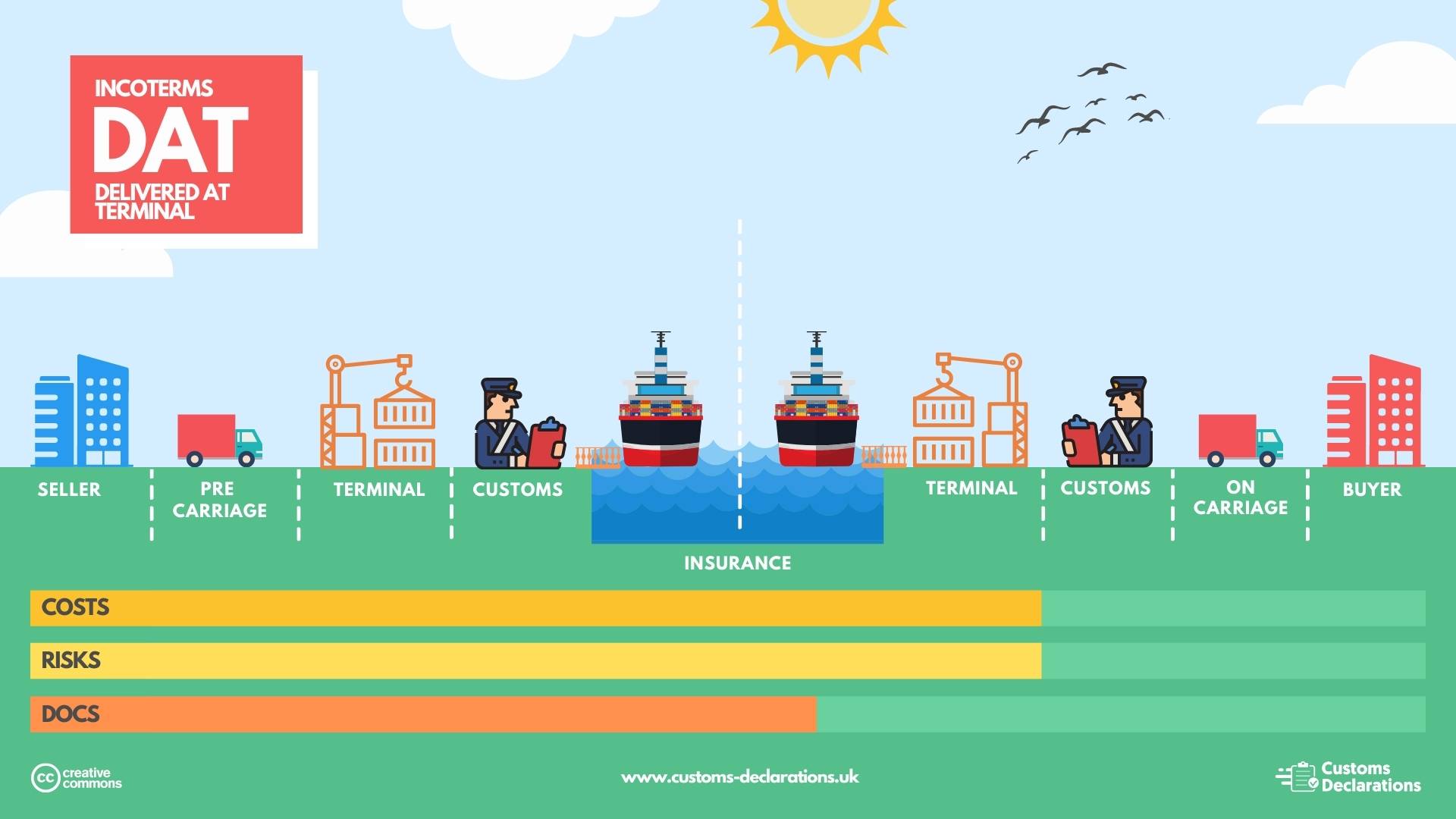

11 – DAT (Delivered at Terminal)

The seller delivers the shipment and passes the risk to the buyer when the shipment is at the buyer’s disposal on the terminal of the final destination. The seller is responsible for export duties, transportation, insurance, destination port costs, and product unloading. The primary distinction between DAT and DAP is that the seller is responsible for final unloading the items under DAT.

- The seller is responsible for export duties, transportation charges, insurance, and destination port costs.

- The buyer is responsible for import duties and unloading the items.

Final thoughts:

Do not be intimidated by incoterms! Freight shipping may be very complicated, but these eleven terms simplify it significantly. With just a few acronyms, you can quickly determine who is responsible for delivering things, who is accountable for what, and whom to call if anything goes wrong. Incoterms is the reason why the global supply chain operates so efficiently.